خدمات الادارة المالية

نحن نساعد الشركات الصغيرة والمتوسطة على التحكم في عملياتها المالية من خلال إرشادات الخبراء الماليين والتقارير الدقيقة وسير العمل الآلي المدعوم بالتكنولوجيا الحديثة وأنظمة ال ERP.

خدماتنا

✅ خدمات الادارة المالية

📊التقارير المالية والتحليل

💸 التحكم بالنقدية

⚙️برنامج ERP متكامل

🧩 الاعتماد على الاتمته و الذكاء الاصطناعي

لماذا تختارنا الشركات الصغيرة والمتوسطة

-

تقارير غير دقيقة أم متأخرة؟ نحن نصلح ذلك.

-

لا توجد رؤية نقدية؟ نقدم لك توقعات.

-

الكثير من العمل اليدوي؟ نحن أتمتة.

-

لا تستطيع تحمل تكلفة المدير المالي بدوام كامل؟ لست بحاجة إلى ذلك.

من نحن

نقدر خدمات الإدارة المالية و الاستشارات على تبسيط العمليات المالية واتخاذ قرارات تعتمد على البيانات. نوفر خدماتنا الهيكل والرؤية والأتمتة لكل مرحلة من مراحل الوظيفة المالية. من خلال دمج الأدوات التي تعمل بالذكاء الاصطناعي وأنظمة ال ERP، لكي نحول التمويل إلى ميزة استراتيجية للشركات الصغيرة و المتوسطة.

Vision

To be Qatar’s leading provider of CFO services—revolutionizing financial management for SMEs through strategic insight and automation.

Mission

To transform traditional accounting through automation and expert CFO guidance, enabling SMEs to move faster, scale smarter, and operate with confidence.

Our Services

At CFO Advisory and Accountancy, we offer end-to-end CFO services designed to bring structure, clarity, and control to your finance function. Our team combines deep financial expertise with advanced technology to help SMEs operate smarter and scale with confidence.

Virtual CFO Services

As your CFO, we focus on structuring and managing your internal finance team while implementing robust controls over financial reporting. Our approach ensures your operations are organized, compliant, and aligned with your business goals.

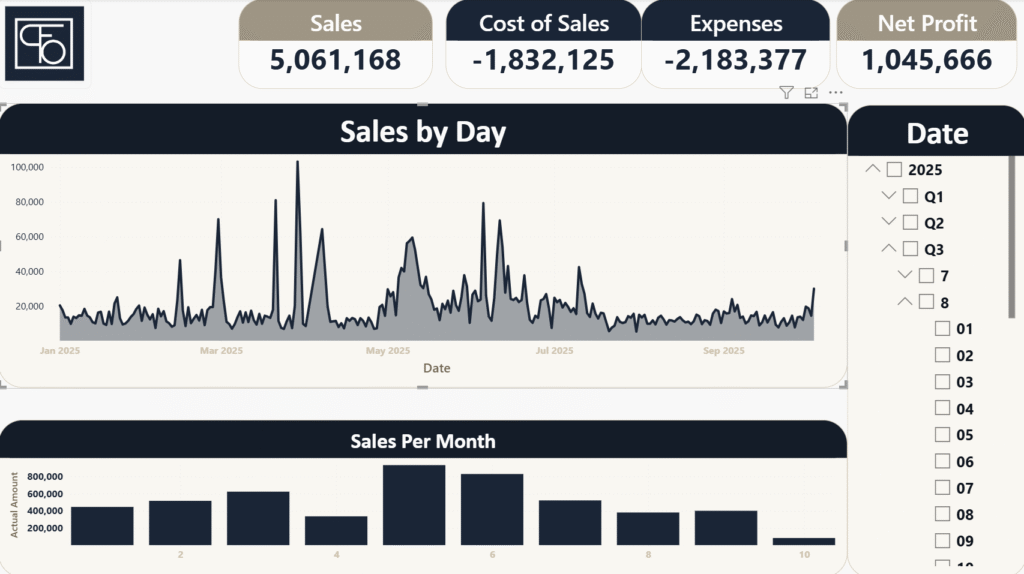

Financial Reporting & Analysis

• Daily financial reports provide real-time visibility into performance, eliminating the wait for month-end accounting. Clients gain timely insights that support faster, smarter financial decisions.

• AI-powered tools enhance financial analysis and reporting accuracy, helping clients stay proactive and performance-focused.

Cash Flow & Forecasting

Robust cash flow planning, budgeting, and financial modeling to ensure your business stays ahead of its commitments.

Automation & Workflow Optimization

Streamlined finance operations using AI-powered tools and ERP systems to reduce errors and save time.

ERP Implementation & Advisory

Selection, setup, and integration of Microsoft Dynamics 365 and other Microsoft solutions to automate and scale your back office — delivered by certified Microsoft partners.

Compliance & Internal Controls

Setup and review of internal financial controls, documentation, and procedures to support audit readiness and regulatory compliance.

Why CFO

Inaccurate or Delayed Financial Reports

Business owners often operate with outdated or incomplete financial data, leading to poor decision-making and missed opportunities.

No Clear Financial Direction

Many SMEs lack budgeting, forecasting, or performance tracking tools, making it hard to plan or measure success.

Cash Flow Uncertainty

Without proper monitoring or projections, businesses frequently face unexpected cash shortages or struggle to manage working capital.

Inefficient, Manual Workflows

Manual bookkeeping, paper-based approvals, and scattered systems waste time, increase errors, and slow down operations.

Difficulty Choosing or Using Accounting Tools

SMEs are overwhelmed by ERP and accounting software options and often lack the expertise to implement or use them effectively.

Lack of Internal Financial Expertise

Hiring a full-time CFO is costly, yet without one, business owners feel unsupported in high-stakes financial decisions.

Our Team

Managing Director

Senior Accountant

Managing Director